Accelerated Depreciation

Instead of depreciating a property over 27.5–39 years, cost segregation accelerates deductions on qualifying components (e.g., decorations, fixtures, landscaping).

Cost segregation is an IRS-approved method that accelerates depreciation, allowing real estate owners to reduce taxable income upfront and increase after-tax cash flow.

We've advised professionals at leading organizations on applying IRS-approved strategies.

The mechanics behind higher after-tax returns

Instead of depreciating a property over 27.5–39 years, cost segregation accelerates deductions on qualifying components (e.g., decorations, fixtures, landscaping).

The One Big Beautiful Bill allows these qualifying components to be fully written off upfront, often unlocking up to ~30% of a property’s value as an immediate deduction.

Major upfront savings from day one. Then every time you replace something, you get two benefits: deduct the new purchase AND write off the old component's remaining value through PAD.

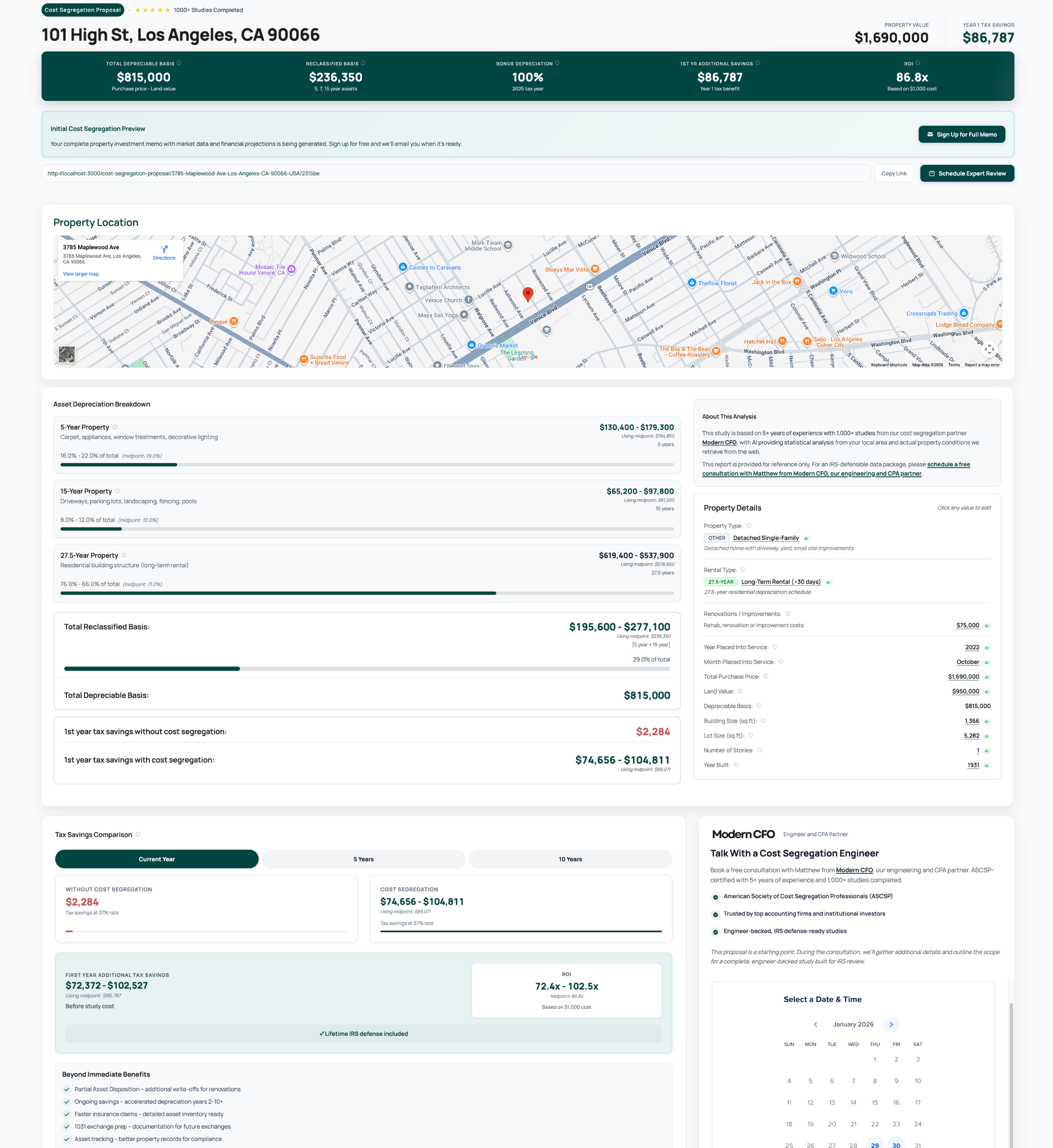

Based on a $1M residential rental property. Actual results vary by property type and structure.

These property components can typically be reclassified from 27.5-year to accelerated depreciation schedules:

CostSeg estimates are based on 10,000+ completed studies, $1B+ in depreciation outcomes, and historical IRS-accepted ranges.

We handle the complexity so you can focus on your investments. Most studies are completed in 2-4 weeks.

Use our calculator above or schedule a call. We'll provide a preliminary estimate of your potential tax savings at no cost.

Share your closing documents and basic property info. No appraisal needed — we work with the documents you already have.

Our certified cost seg engineer analyzes your property using satellite imagery, construction data, and IRS methodology.

Get your IRS-ready report with fixed asset schedules. Share with your CPA and claim your accelerated depreciation.

Our studies are performed by ASCSP-certified engineers using IRS-approved methodology. We stand by our work and provide audit support at no additional charge.

We coordinate with your accountant to ensure seamless filing. You'll receive an Excel fixed asset schedule designed to make your CPA's job easier.

Talk to an ASCSP engineer who will sign off on your study. No commitment required.

Most firms hand you a report and disappear. We connect to your accounting and find tax savings every year.

We deliver institutional-grade cost segregation with disciplined methodology, audit-ready documentation, and durable tax results.

We use construction data, IRS case law, satellite imagery, and insights from 10,000+ studies to identify all eligible tax benefits in your property.

Certified cost segregation engineers review and classify each component using engineering methods, IRS guidance, and relevant case law.

You receive conservative, verified tax benefit estimates upfront—so you know the impact before filing or investing.

In the rare event of an IRS audit, we support you with the documentation and expert guidance needed for review—guaranteed for the lifetime of the study.

ASCSP engineers and experienced CPAs. 10,000+ studies completed. Conservative, IRS-defensible results.

Talk Directly With the Engineer Who Signs Off on Your Study

Principal Cost Segregation Engineer, Modern CFO

ASCSP Member: The American Society of Cost Segregation Professionals sets the industry standard for education, ethics, and technical excellence.

Everything you need to know about cost segregation, our process, and how we help you maximize tax benefits

Cost segregation is a tax strategy that accelerates depreciation by reclassifying portions of a building into shorter-life assets (5-, 7-, and 15-year property). Investors use it to pull deductions forward, often generating significant year-one tax savings while total lifetime depreciation remains the same. See actual savings by property type from our 1,000+ study database.

No, when done correctly. Cost segregation has been explicitly recognized by the IRS for decades. Audit risk typically comes from weak documentation or non-engineered reports, not from the strategy itself.

An IRS-defensible study is based on engineering analysis, asset-level classification, documented assumptions, and support tied to tax law and case precedent. This is the standard we follow for every study we deliver. Read our cost segregation legal guide for the court cases and frameworks that support these classifications.

No. We only provide fully engineered, IRS-ready cost segregation studies. We don't offer template, desktop-only, or non-engineered reports because they often introduce unnecessary risk for investors and CPAs.

Most income-producing properties placed in service after 1986 are eligible. This includes single-family rentals, short-term rentals (Airbnb/STR), multifamily properties, and many commercial buildings. The key requirement is that the property is used for business or investment purposes, not as a personal residence.

The fastest way is to use the free calculator at the top of this page. It gives you a quick estimate of potential depreciation and tax savings so you can decide whether a full engineered study makes sense. For a deeper analysis, read our decision framework based on 1,000+ studies.

The calculator estimates how much of your property could be reclassified into shorter-life assets, how depreciation is accelerated, and the potential tax impact based on your assumptions. It's designed for planning and decision-making. Learn more about how the calculator works and the AI methodology behind it.

The calculator is directional — typically within 10–20% of final study results for standard properties. A full engineered study is more precise because it's based on actual purchase documents, renovation costs, and detailed engineering analysis. Most investors use the calculator first, then confirm with a study. See our full accuracy breakdown.

Yes. You can adjust inputs like land value, tax rate, placed-in-service year, and reclassification assumptions to instantly see how outcomes change. This is useful for tax planning and timing decisions.

Yes. The calculator is free and available instantly. It's meant to help you evaluate whether cost segregation is worth pursuing before committing to a study.

If your property has major renovations, prior depreciation, ownership changes, or you're planning around a specific tax year or deadline, it's usually worth chatting with us. A short conversation can clarify edge cases the calculator can't fully capture.

For purchases, we typically need the settlement statement, purchase agreement, and basic property details. For renovation projects, we review improvement invoices, contractor scopes, and placed-in-service dates. We'll clearly outline exactly what's needed after a short intake.

Most engineered studies are completed in 2–4 weeks after we receive the required documentation. If you're working against a tax deadline, we recommend reaching out early to confirm timing.

Our cost segregation studies start at $499 for a simple single-family rental and increase based on property size, complexity, and scope of analysis — roughly 50% less than traditional firms. We provide a fixed-fee quote upfront so you can clearly evaluate return on investment before moving forward.

Yes. Our studies are built to be CPA-ready with clear schedules, classifications, and supporting documentation. We're also happy to coordinate directly with your CPA to make filing straightforward.

If the IRS reviews your return, we provide documentation and technical support to help your CPA respond. Our methodology and reporting are designed with audit review in mind.

The IRS requires depreciation to be calculated using your actual cost basis, not current market or appraised value. Depreciation is meant to recover your investment in the property, not unrealized appreciation, which keeps deductions objective and verifiable.

If you're early in the process, start by running the free calculator above. If you want to learn more first, explore our guides: Is cost segregation worth it?, How much does it save?, and Why our studies cost 50% less. If the numbers look meaningful or your situation is more complex, chat with us and we'll help you decide the best next step.

Your study will be personally signed off by Matthew Gigantelli, Principal Cost Segregation Engineer at Modern CFO — our trusted engineering and CPA partner. Matthew's credentials include: 5+ years specialized in cost segregation engineering, $1Bn+ in accelerated depreciation delivered, 1,000+ studies completed across all property types, methodology aligned with IRS Audit Techniques Guide, and ASCSP certification (Member #M009-25). Book a call with Matthew directly →

Cost segregation isn't right for everyone. It may be a poor fit if: (1) You can't use the deductions — W-2 earners without Real Estate Professional Status or the short-term rental loophole face passive activity limitations that suspend cost seg losses, meaning you can't offset your salary. (2) You're selling within 18 months — depreciation recapture taxes at ordinary rates (up to 37% for Section 1245 property) can erase most of the benefit on short holds. (3) Your depreciable basis is under $200K and study fees are high — the net savings may be thin. (4) You're in a low tax bracket (12–15%) — deductions are worth less at lower rates. (5) The provider isn't qualified — non-engineered or template-based studies create audit risk without defensible results. We believe in honest assessments — if cost segregation doesn't make sense for your property, we'll tell you. Read our full guide: Why cost segregation is a bad idea (sometimes).

When you sell a property, the IRS 'recaptures' accelerated depreciation and taxes it. Section 1250 property (buildings) is recaptured at up to 25%. Section 1245 property (the personal property that cost segregation reclassifies — fixtures, flooring, appliances) is recaptured at ordinary income rates up to 37%. This doesn't eliminate the cost seg benefit — on holds of 3+ years, the time value of Year-1 savings almost always exceeds recapture costs. And 1031 exchanges defer recapture entirely. The key is planning for recapture from day one, not being surprised by it at exit. See our guide on why tax strategies fail at exit.

Only if you meet specific IRS requirements. Standard rental income is classified as 'passive' under IRC §469, which means losses can't offset W-2 income. Two exceptions unlock this: (1) Real Estate Professional Status (REPS) — requires 750+ hours/year in real estate AND more than 50% of your total working time, which is difficult with a full-time job. (2) Short-term rental loophole — if your rental has an average guest stay under 7 days and you materially participate (100+ hours/year), it's not classified as a 'rental activity' and losses can offset any income. Without either exception, cost segregation deductions are suspended until you generate passive income or sell the property. This doesn't mean they're lost — just delayed. Read our full guide: Cost segregation for W-2 earners.